How AI Is Scaling Intelligence Across Finance Industry

AI is becoming essential to the financial industry’s broader digital transformation goals. As data volumes rise and customer expectations shift toward immediacy, precision, and always-on service, financial institutions are recognizing AI’s potential to improve decision-making, strengthen operations, and increase the speed and quality of customer engagement. With tools, models, and deployment frameworks becoming more mature, AI is moving beyond experimentation and into production across multiple business lines.

Across banking, insurance, and asset management, AI adoption is concentrated around three major domains where it consistently demonstrates measurable value: Customer Intelligence, Risk and Decisioning, and Market and Data Intelligence. Together, these areas represent the foundation of how modern financial institutions generate insights, manage complexity, and deliver differentiated services.

Customer Intelligence and Experience Transformation

Financial institutions are shifting from product-centric engagement to data-driven, personalised customer journeys. AI enables deeper understanding of individual behaviour, intent, and financial circumstances, leading to more relevant and timely interactions.

- Hyper-Personalization and Targeted Offerings

AI synthesizes behavioral data, spending patterns, life-stage indicators, and risk profiles to tailor credit limits, loan pricing, protection products, and investment guidance. This precision improves conversion and strengthens long-term loyalty.

- Intelligent Customer Service and Autonomous Support

AI-powered service agents resolve inquiries, retrieve account information, and complete tasks instantly while supporting multiple languages and channels. Institutions benefit from reduced operational costs and more consistent service quality.

- AI-Augmented Advisory and Scenario Planning

Advisors and clients use AI-generated analysis portfolio diagnostics, risk-return scenarios, economic simulations to make more informed decisions. This elevates advisory capabilities and increases planning accuracy across retail and wealth segments.

Increasingly, financial institutions view customer intelligence as a strategic differentiator, using AI to power personalized journeys at scale.

Risk, Compliance, and Core Decisioning

Effective decisioning lies at the heart of financial operations. AI strengthens the precision, speed, and consistency of these processes, enabling institutions to manage uncertainty with greater clarity.

- Risk Management and Fraud Prevention

Machine learning models detect anomalies across transaction networks, devices, accounts, and behavioural patterns. Compared with rule-based systems, AI adapts quickly to new threats and reduces false positives which is critical for fraud, AML, and risk surveillance.

- Automated Underwriting and Credit Decisioning

AI-based scoring models incorporate wider data sets and produce more holistic assessments of creditworthiness while supporting clear rationales. As a result, approval cycles shorten, portfolio quality improves, and new credit products become feasible.

- Compliance and Reporting Automation

AI extracts, verifies, and reconciles information from documents, forms, and internal records to accelerate KYC reviews and reporting tasks. Intelligent validation ensures greater completeness and accuracy in financial reporting and disclosure.

AI in this domain enhances operational resilience and supports high-volume, high-accuracy decision workflows across the enterprise.

Market Intelligence and Data Automation

In a market defined by rapid information cycles and increasingly complex data streams, AI provides institutions with analytical leverage and real-time insight.

- Predictive Analytics and Forecasting

Models anticipate shifts in liquidity demand, pricing risk, loan performance, customer churn, and macroeconomic indicators. These forecasts support better planning, capital allocation, and risk mitigation.

- Algorithmic Trading and Market Analytics

AI identifies patterns across large, fast-moving data sources market data, news sentiment, macro signals and supports traders with improved strategy optimisation and execution.

- Advanced Data Synthesis, Document Intelligence, and Narrative Reporting

LLM-driven systems interpret filings, contracts, statements, and regulatory documents, transforming unstructured information into structured, analysable formats. AI also generates narrative explanations of results, enabling faster reporting cycles and supporting emerging “continuous close” practices where financial insights are updated in near real time.

These capabilities give institutions a more complete and timely view of their financial and market environment.

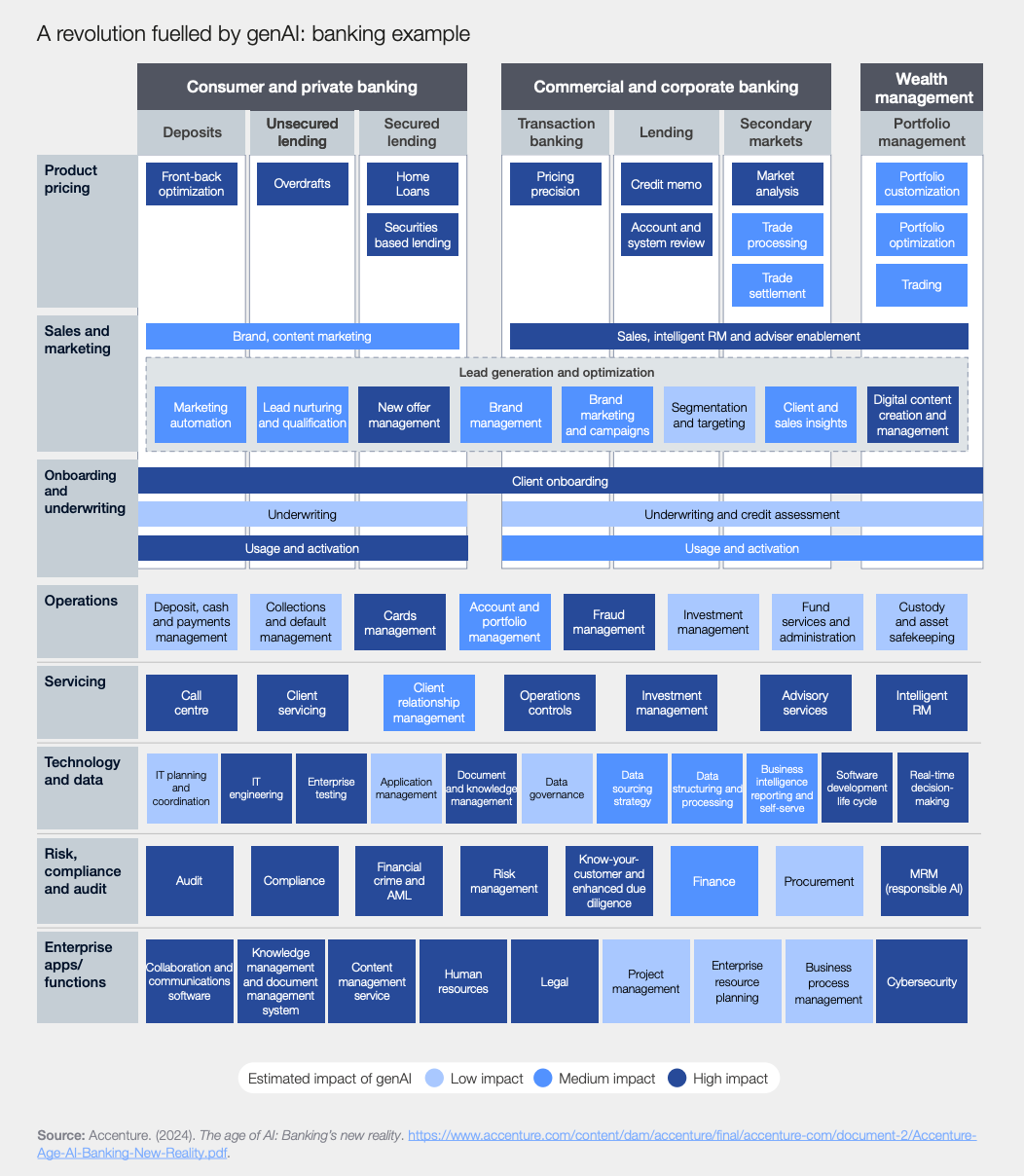

As this overview shows, AI is reshaping nearly every function in modern banking, with impact spanning pricing, onboarding, operations, servicing, and risk. The challenge is no longer identifying use cases, it’s building the infrastructure to scale them consistently across the organization. This is where a unified AI platform becomes essential.

Figure 1. Banking Example (Source The World Economic Forum )

How Bitdeer AI Power Financial Solution

To operationalize AI at scale, financial institutions need a unified environment that integrates high-performance compute, secure data infrastructure, production-ready models, and automated workflows.

Bitdeer AI provides a unified cloud environment that combines scalable GPU compute with secure data and model-development tools. Through AI Studio covering notebooks, RAG pipelines, and training jobs that teams can build, refine, and deploy open-source LLMs efficiently while relying on integrated databases and vector search for data-driven financial workflows.

On top of this foundation, the Agent Builder allows institutions to create custom agentic workflows using open-source models, tool integrations, and database queries. These agents automate tasks such as document understanding, KYC data extraction, validation, and summarization, helping financial teams streamline high-volume processes with greater consistency and speed.

Conclusion

AI is reshaping how financial institutions operate, powering more personalised customer experiences, more accurate decisioning, and faster, insight-driven reporting. As AI capabilities mature, the institutions that succeed will be those able to deploy them consistently and securely across their core operations. With an integrated platform designed for high-performance, production-grade AI, Bitdeer AI enables financial organizations to scale these capabilities with confidence and unlock the full value of intelligent transformation.